Changing Grid is a new data-driven series from StreetEasy that explores new developments or rezoning sites across New York City and examines the potential impact they’ve had on the real estate market of surrounding neighborhoods.

The inaugural installment of this series is a deep dive into the history and impact of the High Line.

Highlights

- StreetEasy looked at the first two sections of the High Line to track the progress of real estate development in the surrounding neighborhoods.

- By June 2011 (when Section 2 opened), the median resale price for properties surrounding Sections 1 and 2 of the High Line increased to $1,422,899 and $877,152, respectively, outpacing the neighborhood at large where the median resale price was $763,301.

- The median resale price for real estate in Section 1 reached $2,143,287 in May 2016. This is over 100 percent more than the real estate value in the “comparison area” just one block to the east and is over 75 percent higher than the rest of Downtown Manhattan.

- Since June 2011, Section 1 prices have increased by 50.6 percent and Section 2 prices have increased by 48.2 percent. The comparison areas have appreciated only 31.4 percent over this same time period.

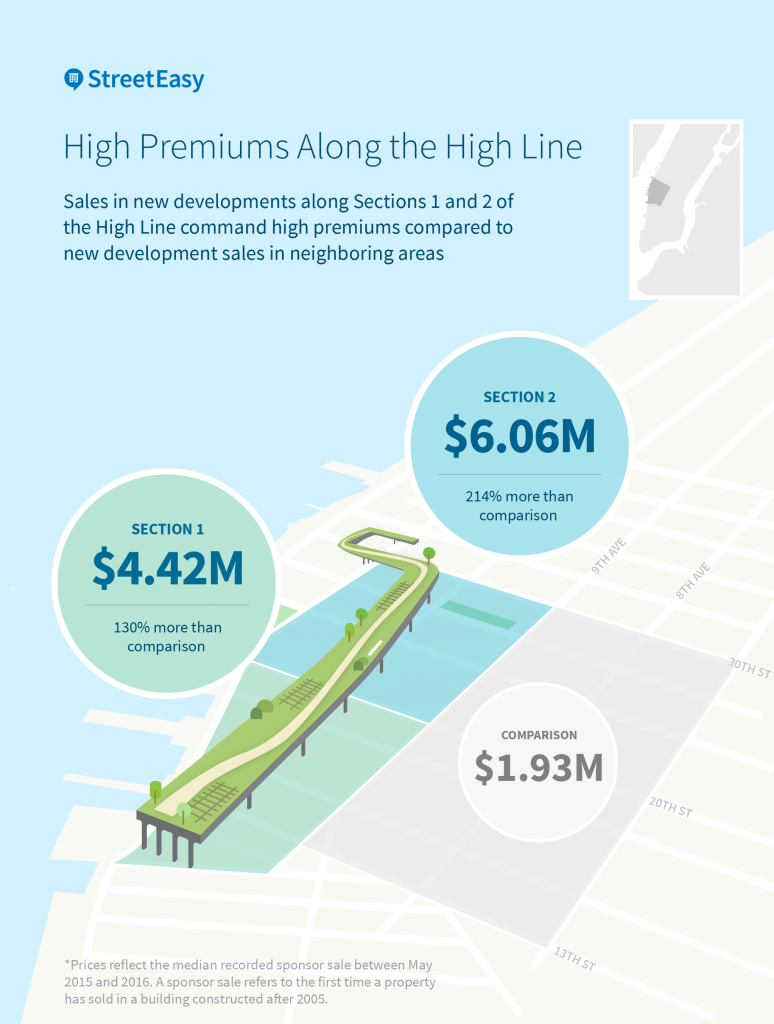

- In the past year, the median recorded sale price for a sponsor sale in new buildings within Section 1 was $4,419,205 and $6,058,587 in Section 2. These prices reflect 130 percent and 214 percent premiums over the comparison area.

The High Line’s Halo Effect and How It Happened

There are few conversion stories about New York City better than that of the High Line, with its abandoned, overgrown train tracks reborn as a glittering and groundbreaking public space. The narrative is a familiar one beginning with a disused elevated railroad facing demolition only to be rescued by a cast of intrepid, forward-thinking Downtown elite including Diane von Furstenberg, Barry Diller, Michael Bloomberg and the Friends of the High Line, an NGO that now operates the city-owned park. The ending couldn’t be happier, complete with a marriage between park space, real estate development and the rebirth of a liminal neighborhood as one of the most expensive and innovative in the city.

That’s the Broadway version of the story, but behind the scenes there were many levers being pulled to make the whole thing come together. Most crucial of all was the Bloomberg Administration’s approval of the West Chelsea Special District, which rezoned the neighborhood from a light industrial area to an area for mixed commercial and residential development. The rezoning allowed for the development of 15 new residential buildings and the addition of 2,000 new units, a 50 percent housing stock increase to the 4,000 units already existing in West Chelsea at the time.

Much of the High Line lies smack dab in the middle of the West Chelsea Special District, which is generally bounded by 10th and 11th avenues between West 16th and West 30th streets. The success of the park space and the new developments around it go hand-in-hand. The buildings would not exist if it weren’t for the changes in zoning and the High Line would not be the same without the surrounding buildings. This relationship between the new buildings and the park is cemented when we look at the unparalleled real estate prices associated with those addresses.

High Line Construction Sections 1 and 2 – How Real Estate Prices Compare

While the changes in the infrastructure and ambiance of the neighborhood around the High Line are immediately apparent, the economic impact on the area’s real estate value is not. Sure, we all assume the real estate around the High Line is crazy expensive, but just how out of this world is it? Well, let’s just be clear — it is completely unprecedented.

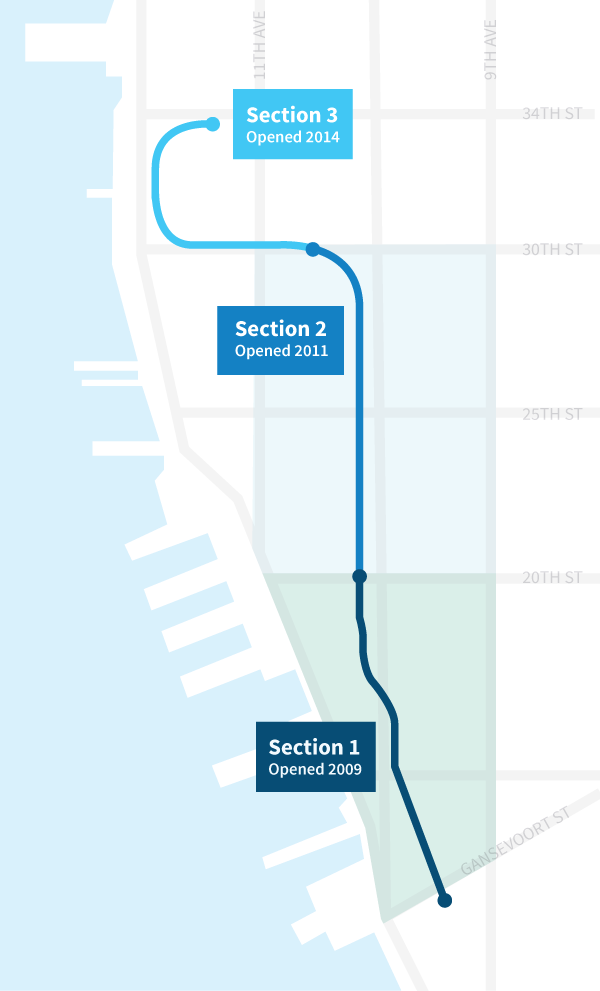

The High Line was constructed in three sections as the park developed from its southern-most tip at Gansevoort Street and made its way northward to its terminus at West 34th Street (see the map below).

StreetEasy looked at the first two sections of the High Line to track the progress of real estate development in the surrounding neighborhoods. In the area surrounding Section 1 of the High Line, the StreetEasy Price Index, which tracks repeat sales over time, reached $2,143,287 in May 2016. This is over 100 percent more than the real estate value in the “comparison area” just a mere block to the east between 9th and 7th Avenues and is over 75 percent higher than the rest of Downtown Manhattan. The city’s most expensive submarket, Downtown Manhattan, includes such neighborhoods as Tribeca, SoHo, West Village, Battery Park City and Gramercy Park.

In Section 2, real estate prices directly surrounding this area of the High Line (which opened in June 2011) reached $1,300,281 in May 2016. This is substantially lower than Section 1 but still 7 percent higher than the rest of Downtown Manhattan. What’s really interesting, though, is that prices in Section 2 are growing faster than in Section 1, 11.7 percent year-over-year compared with 9.7 percent in Section 2.

Whichever way you cut the numbers, it’s clear the premium that High Line real estate commands is astronomical.

High Line’s Economic Impact Is Unprecedented

Although the scale and scope of the High Line’s impact on surrounding real estate value is only coming to light now, from the get-go, the potential was palpable. At the ribbon-cutting ceremony for the first section of the High Line in June of 2009, Bloomberg painted a bleak picture of Chelsea before the High Line, describing the area 10 years ago as “an eyesore.”

Councilwoman Christine Quinn reiterated Bloomberg’s assessment pointing to the High Line’s rough beginnings as “once blighted and abandoned.” The silver lining to all the references to past blight and unsightliness, however, was always the economic potential that the High Line had to offer. According to estimates produced by the Friends of the High Line, the park would increase the city’s tax revenues by $250 million over 20 years due to increased real estate value.

Economic Development Corporation President Seth Pinsky also spoke of “the promise that [the High Line] represented” arguing that in just five years since it opened it “already catalyzed a remarkable transformation of this great and storied neighborhood.”

Two years later at the opening of the second section of the High Line, this narrative continued and it was clear even then that the High Line’s success was unprecedented. At that ribbon cutting ceremony, Robert Hammond, one of the co-founders of the Friends of the High Line admitted that the economic gain for the area around the High Line was already surpassing expectation. “We had no idea that it would happen this fast.” At that time, the median resale price for residential real estate surrounding Sections 1 and 2 of the High Line had already increased to $1,422,899 and $877,152, respectively, outpacing the neighborhood at large where the median sale price was $763,301.

By 2014, the High Line was expected to produce $900 million in tax revenue over 20 years, making the initial estimates of $250 million seem laughable. On top of that, the city was attributing an additional $2 billion in new economic activity to the High Line, citing its impact on West Chelsea as a hub for retail and office space.

Likewise, the premiums that real estate in Section 1 and Section 2 were commanding had grown even more apparent. Between June 2011 (when Section 2 opened) and June 2014, the median resale price for real estate along Section 1 increased 32.2 percent to $1,880,362; median resale price for Section 2 real estate increased 24.3 percent to $1,090,232. As of May 2016, resale prices for real estate along Section 1 of the High Line increased 50.6 percent and 48.2 percent in Section 2 since June 2011. Over this same time period, prices in the comparison area appreciated 31.4 percent.

High Line Real Estate Immune to Luxury Market Slowdown

That pace of growth for residential real estate along the High Line has continued at an exceptional rate and proves to be impervious to trends affecting the luxury real estate market at large. In the past year alone, the resale value for homes immediately abutting the High Line have continued to grow while everywhere else in Manhattan resale prices for luxury homes have declined. Since last May, prices for homes in Section 1 and 2 have appreciated by nearly 10 and 9.4 percent, respectively, while prices for luxury-tier homes in Manhattan at-large have depreciated by 0.3 percent.

The fact that real estate in Section 1 and 2 bucks citywide trends in the luxury market is testament to the singularity and power of the High Line’s secret sauce – its incredible combination of modern park space, views and stunning architecture. Luxury buyers have a growing appetite for these properties, driving up their resale value as well as commanding astronomical prices for new construction. Properties in those few new buildings of Section 1 and 2 cost a premium. In the past 12 months, the median recorded sale price for a sponsor sale in new buildings in Section 1 was $4,419,205 and $6,058,587 in Section 2.

These are substantially higher than the same prices in the comparison area, which at just over $1.93M was 56 percent and 68 percent less, respectively. Another nine buildings are under construction near the High Line, which had a median asking price of $7,122,500 in May 2016.

West Chelsea Before the High Line

To say that the High Line was the sole catalyst for change in Chelsea, however, overlooks the fact that the neighborhood was well on its way to change long before the idea of an elevated park on a former train track was ever conceived. By December 1999, real estate in Section 1 was already at a premium, commanding a median resale price of $743,000 — 82 percent greater than the rest of Downtown Manhattan, which was only commanding $407,000. The sex clubs and BDSM scene that had become synonymous with the Meatpacking District and Chelsea in the late 1970s and 1980s – what had given the area its seedy edge – were long gone. In fact, it began to decline as early as “1985 when the state gave permission to Mayor Koch to padlock all the city’s gay bathhouses, bars and clubs where ‘high risk sexual activities were taking place.’ ”

The High Line in the 1970s. Image Source: Flaming Pablum

In the years that followed, artists and galleries – those telltale signs of imminent neighborhood change – entered looking for big space and low rent. The tipping point came in 1999, according to Jeremiah Moss of Vanishing New York, when a pair of trendy restaurants opened, ushering in a new wave of bougie, bohemian clientele. “From there, the floodgates opened and the old world quickly came to an end,” wrote Moss.

In 1997, Diane von Furstenberg relocated the headquarters of her fashion line to a brand-new 5,000-square foot six-story building in Chelsea complete with a Swarovski crystal detailed staircase, reflecting pool and roof garden. The glittering building set a new standard for the area paving the way for the many high-end designers who followed DVF’s lead. In many ways, the arrival of the DVF headquarters presaged the support for the preservation of the High Line and its subsequent economical and aesthetic success.

It goes without saying that the High Line holds an essential place in the city’s urban landscape as well as in the itineraries of New York City tourists. In 2014 the park attracted 20 million visitors, nearly twice as many visitors as the Statue of Liberty. Its innovative mix of architecture, green space and stunning vistas has set the standard for urban renewal, landscape design and rail-to-trail parks with communities from the Lower East to Queens and the Bronx all angling to get their own version. Take one look at the droves of sightseers there on a weekend afternoon, the proliferation of linear parkway design around the city or the litany of cranes and construction sites on either side of the park and you can see the physical and social impact the High Line has had on the city.

Below is a map that highlights the new residential buildings that have been built both as a result of and in tandem with the development of the High Line. These 30 buildings spread across Section 1 and 2 have undoubtedly contributed to the astronomic growth in West Chelsea real estate prices and have dramatically changed Downtown Manhattan’s architectural landscape.

[tableau server=”public.tableau.com” workbook=”highlinebuildings” view=”Dashboard1″ tabs=”no” toolbar=”no” revert=”” refresh=”yes” linktarget=”https://public.tableau.com/views/highlinebuildings/Dashboard1?:embed=y&:display_count=yes&:showTabs=n” width=”800px” height=”870px”][/tableau]

The High Line at the Rail Yards and What Lies Ahead

The third and final section of the High Line, dubbed the High Line at the Rail Yards, opened to the public in September of 2014. Its opening marked the end of 15-year process of development, culminating in a single stretch of walkable park from Gansevoort Street all the way to West 34th Street. It is a process that has catalyzed rapid change in the surrounding area’s infrastructure, real estate values and physical and social environment. Despite all the dramatic change the High Line has ushered in, its terminus at 34th Street, overlooking that intersecting warren of Penn Station’s rail yards, is a fitting reminder of what the area once was. The evidence of the city’s remaining transportation infrastructure and its industrial past, however, will increasingly be overshadowed by the Hudson Yards, the $20 billion mega-project steered in large part by the Related Company as well as the Oxford Properties Group.

The largest private real estate development in the history of the United States, the Hudson Yards project is currently in the process of converting 28 acres between 10th and 12th avenues from West 30th to 34th streets into a mini citadel above the rail yards of office buildings, shops, restaurants and residential real estate. Upon completion – slated for 2024 – Related’s complex on the West Side will encompass 17 million square feet of commercial and residential space including 100 shops and restaurants and 4,000 housing units.

What impact this will have on the value of High Line real estate, only time will tell. If the current trends hold true, the launch of a major new development nearby will only extend the economic success of the High Line and further entrench the High Line in the social and aesthetic infrastructure of the city.